We are Orgallic

This is What we do

We call them our F.A.I.R. Services: Fee-only, Aligned, Integrated, & Refined

Our two core offerings include everything in our Comprehensive Approach:

We like transparency – see our fees below.

We do not earn any revenue through commissions or third-party compensation. For more information, take a look at our Form ADV.

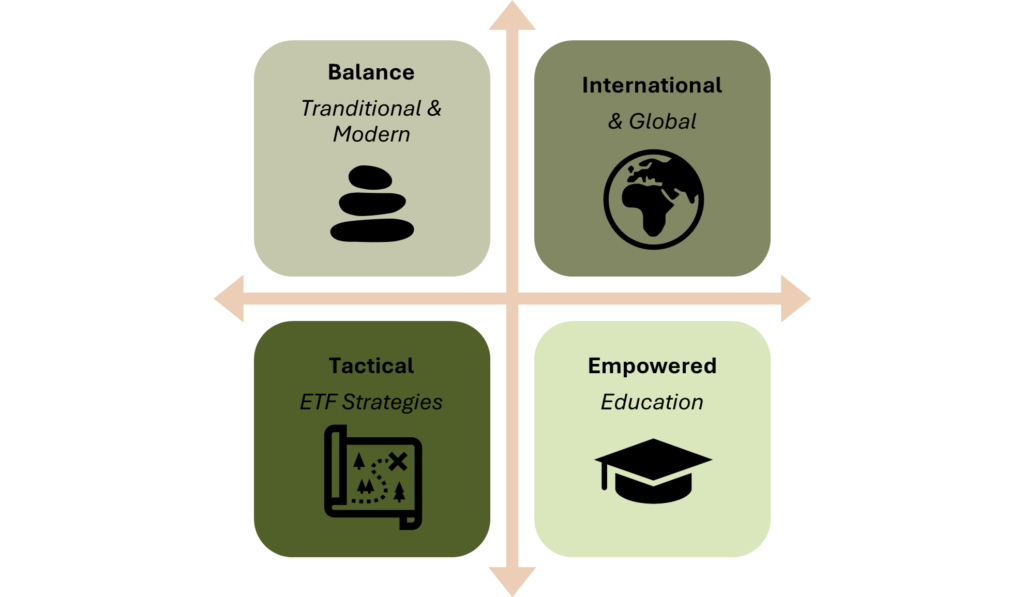

This is How we do it

We bring the M.E.T.R.I.I.C.S. System™ into the equation!

Always included—either deeply or at a high level—depending on your needs as we build strategies and make recommendations.

Here’s how we are G.U.I.D.I.N.G.™ you on your financial journey – in 7 Steps.

But wait, we said 7 steps! We wouldn’t be doing you a favor if we stopped there.

This is our Story

I’ve witnessed the highs and lows of financial situations, and I know firsthand what it’s like to feel anxious about money. At 17, I found myself homeless, which gave me a unique understanding of the dreams and aspirations of those who start with nothing.

I’ve seen both sides of the financial advice coin: cookie-cutter solutions and advisors who focus solely on goals without considering the risks you face. That’s why I founded Orgallic—I believe we can do better. By combining risk assessments with goals-based financial planning, we develop personalized plans that genuinely reflect your unique circumstances while addressing the challenges that might impact your success.

Be the exception, not the rule.

Victor P. Davidenko, Founder